As of January 1, 2024, California’s new paid sick leave law has taken full effect and affects both employers and employees across the state. This updated legislation mandates a minimum of 40 hours or five days, whichever is more, of paid sick leave annually to ensure that workers have adequate time to address their health needs without financial penalty. This change is a substantial increase from the previous requirements and reflects California’s commitment to enhancing worker protections and benefits.

Employers must comply with these new requirements to avoid penalties and ensure their workforce remains healthy and productive. The California Labor Commissioner has updated the paid sick leave poster and the 2810.5 employee notice, which must be prominently displayed in all workplaces. Organizations that previously offered less than the mandated 40 hours or five days of paid sick leave per year are now required to update their policies and distribute the new notices to their employees. Understanding and implementing these changes is crucial for all businesses operating in California to maintain compliance and support their employees’ well-being.

If your employment rights have been violated, call us today at (866) 936 7349 to schedule a free consultation

New 2024 Paid Sick Leave Change Summary

The new paid sick leave law [1] in California brings several significant updates that employers must implement. These changes are designed to provide greater flexibility and protection for workers and ensure they have sufficient paid time off to address health concerns for themselves and their families. Below is a summary of the key points of the 2024 updates:

- Increased Sick Leave Entitlements: The minimum employer-mandated paid sick leave has been raised from three days or 24 hours to five days or 40 hours annually.

- Accrual Methods: Employers can choose between frontloading the entire amount of sick leave at the beginning of the year or allowing employees to accrue sick leave over time. Regardless of the method, employees must be able to access 24 hours of sick time or more by their 120th day of employment.

- Calculation Formulas: The law specifies different calculation methods for exempt and non-exempt employees.

- Permitted Uses: Paid sick leave can be used for medical treatment for the employee or their family members. Employers cannot require proof of treatment or dictate how the sick leave is used.

- Posting and Notification Requirements: Employers must post the updated sick leave notice and provide employees with the 2810.5 notice detailing their rights under the new law.

- Compliance with PTO Policies: While separate PTO and sick leave policies are not necessary, combined policies must comply with the new sick leave regulations to avoid penalties.

What is Paid Sick Leave?

Paid Sick Leave (PSL) is a permanent requirement in California that mandates employers to provide paid time off to workers for various health-related needs [2]. The law stipulates that employers must offer at least 40 hours or five days, whichever is more, of paid sick leave each year. This provision applies to most workers, including full-time, part-time, and temporary employees as long as they meet the following criteria:

- They have been employed by the same employer for at least 30 days within a year in California.

- They have completed a 90-day employment period before they can start using their paid sick leave.

PSL can be used for a variety of purposes, including:

- Recovering from injury or mental illness.

- Seeking diagnosis, treatment, or preventative care for a medical problem or issue.

- Caring for a family member who is ill and requires medical treatment or preventative care.

- Dealing with the aftermath of abuse, assault, or stalking that you are a family member have experienced.

Employers have the flexibility to provide more than the minimum required PSL hours or days off. They can either allocate all the hours at once at the beginning of the year or have employees earn the hours through an accrual system.

Which Workers are Eligible for California Sick Leave?

The new California paid sick leave law applies to a wide range of workers to ensure that most employees in the state have access to necessary time off for health-related reasons. To qualify for paid sick leave, employees must work for the same employer for at least 30 days within a calendar year and complete an initial 90-day employment period before they can use their sick leave. The law covers various types of workers, including:

- Part-time employees

- Per diem workers

- In-home supportive services (IHSS) providers

- Temporary employees

- Employees of staffing agencies, where the staffing agency or joint employer must provide paid sick leave

However, there are some exemptions to this law. Workers who are not covered include:

- Air carrier employees such as flight deck or cabin crew members, provided they receive compensated time off equivalent to the new law’s requirements

- Railroad employees

- Retired annuitants that work for the government

- Construction industry employees who are covered by a collective bargaining agreement (CBA) that contains specified provisions

Additionally, employees outside the construction industry who are covered by a qualifying CBA are partially exempt but still entitled to some paid sick leave. These employees must be allowed to use sick leave for all purposes specified in the law and cannot be required to find a replacement to take their sick leave.

Sick Leave Law Implications for Seasonal Workers

The new California sick leave law includes specific provisions designed to support seasonal workers. It is important to understand that the 90-day employment period required to qualify for paid sick leave does not need to be continuous. If a seasonal worker leaves an organization and returns within the same calendar year, the employer must credit the worker for any previously accrued sick leave assuming it was not cashed out at the end of their initial employment. This means that seasonal workers can retain their accrued benefits to ensure they have access to paid sick leave when they return to work. However, if the accrued sick leave was paid out or cashed out upon their departure, they must start accruing leave again.

Does Paid Sick Leave Get Restored After a 12 Month Break in Employment?

Under the new California sick leave law, sick leave that is accrued by employees who then take a break in employment from a company that lasts longer than a 12 month period is forfeited. There is a yearlong statute of limitations that starts counting when employment is terminated or paused. As long as employment is reinstated within 12 months of the previous period of employment, the previously accrued sick leave hours can be reinstated.

If your employment rights have been violated, call us today at (866) 936 7349 to schedule a free consultation

How the New California Paid Sick Leave Law Changed

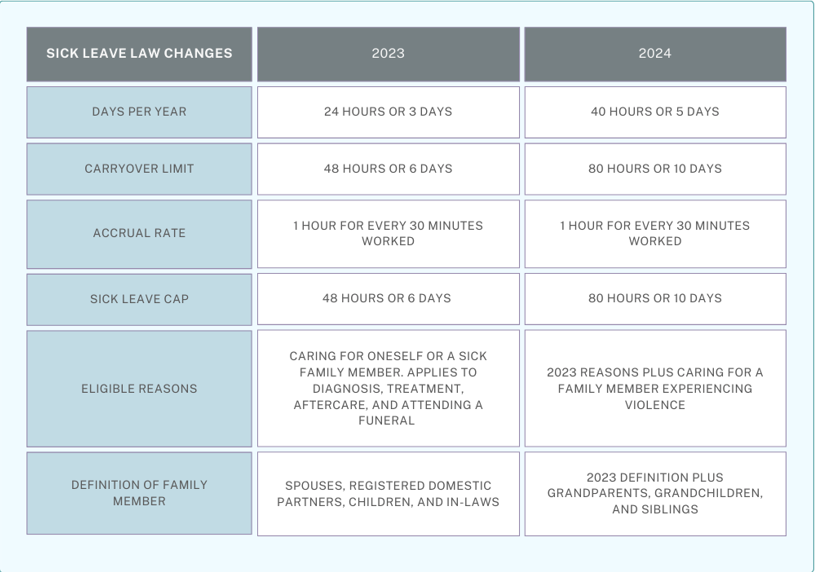

The new California paid sick leave law has increased the minimum allowance for paid sick leave from 24 hours or three days to 40 hours or five days annually. Previously, employers could limit the use of paid sick leave to 24 hours or three days per year, with an overall accrual cap at six days. Under the new law, these limits have been raised by 66% to allow employees to use up to five days per year and capping accruals at 80 hours or 10 days. These changes have substantial implications for businesses as they are now required to adjust their policies and ensure compliance with the updated regulations.

Guide to California’s New Sick Leave Days / Hours Requirement

Employers must now provide and allow employees to use the greater of 40 hours or five days of paid sick leave per year. This requirement ensures that employees working various schedules receive a fair amount of paid time off, regardless of their daily hours. For example, if an employee works 11-hour days, they would be eligible for 55 hours of paid sick leave annually (5 days x 11 hours), because the total hours worked surpass the minimum 40-hour requirement.

Conversely, if an employee works shorter days, such as seven-hour shifts, they are still entitled to at least 40 hours of paid sick leave, even though their five-day allotment would total only 35 hours. This means that employees working fewer hours per day will receive additional paid sick leave to meet the 40-hour minimum. These rules ensure equitable sick leave benefits across different work schedules to accommodate the needs of all employees and provide adequate time for health-related issues.

Employer’s Obligation to Inform Employees of Paid Sick Leave Laws

Employers have specific obligations to inform their employees about their rights and entitlements regarding paid sick leave. These requirements ensure that employees are aware of their benefits and protections under the new law. Employers must adhere to the following informational and posting requirements:

- Workplace Posting: Employers are required to display a poster in an area frequented by employees where it can be easily read during the workday. The poster must include:

- Information that employees are entitled to accrue, request, and use paid sick days.

- The amount of sick days provided and the terms of use.

- A statement that retaliation or discrimination against an employee who requests or uses paid sick days is prohibited.

- Notice that employees have the right to file a complaint with the Labor Commissioner against employers who retaliate or discriminate against them.

- Notice to Employee: Employers must provide most employees with an individualized Notice to Employee, as required under Labor Code section 2810.5. This notice must include details about the paid sick leave policy and the employees’ rights under the law.

- Pay Stub Line Item: Employers must reflect the amount of sick leave available on each pay stub or on a document issued the same day as the paycheck. This ensures that employees are regularly updated on their available sick leave balance.

- Record-Keeping: Employers must keep accurate records showing the amount of sick time earned and used by each employee for at least three years. These records should be stored in a way that is accessible to employees, either electronically or in paper form.

Do Local Laws Supersede State Paid Sick Leave Regulations?

When it comes to paid sick leave regulations, businesses in California must adhere to the standard that is most generous to the employee. This means that if a local jurisdiction requires a higher paid sick leave allotment than the state law, the business must comply with the more generous local standard. For instance, if a city mandates 48 hours of paid sick leave while the state law requires only 40 hours, employers in that city must provide 48 hours of leave.

However, there are specific aspects where state law prevails over local ordinances. As of January 1, 2024, local laws cannot contradict state regulations regarding the advance of paid sick leave, paystub statements, calculation of sick leave, notice requirements if leave is foreseeable, timing of sick leave payment, and payment upon termination. In these areas, state law preempts local laws to ensure consistency and clarity in the application of paid sick leave benefits. Therefore, employers must navigate both local and state requirements to ensure they provide the most favorable terms to their employees while adhering to the overriding provisions set by state law.

If your employment rights have been violated, call us today at (866) 936 7349 to schedule a free consultation

How Does Paid Sick Leave Accrue Under New Sick Leave Changes

Under the new sick leave changes, employers in California can choose to provide paid sick leave through either an “accrual” policy, where employees earn sick leave over time, or an “up front” policy, where the full amount of sick leave is provided at the beginning of the year.

1:30 Accrual Method:

The accrual policy for allocating paid sick leave requires employees to earn sick leave over time. This method typically adheres to a 1:30 schedule, meaning that one hour of paid sick leave is accrued for every 30 hours worked. Employees must accumulate at least 24 hours of sick leave by the 120th calendar day of employment and the full 40 hours by the 200th calendar day. This ensures that employees steadily accrue sick leave and have sufficient time off as they continue their employment.

Employers can adopt alternative accrual methods, provided they meet or exceed these minimum requirements. For example, a more generous accrual rate could be one hour of sick leave for every 20 hours worked. Regardless of the method, the law allows employers to cap the use of paid sick leave at 40 hours or five days per year and the total accrual at 80 hours or ten days. This policy ensures a fair distribution of sick leave while maintaining flexibility for different business needs.

Under the Accrual Policy, Can I Carry Over Unused Sick Leave into a New Year?

Under the accrual policy, employees can carry over unused sick leave into a new year. However, employers have the right to limit or cap the total amount of sick leave an employee can accrue. This means that while employees can accumulate and carry over sick leave from year to year, there is a maximum limit to how much can be accrued at any given time.

This carryover provision ensures that employees retain their earned sick leave benefits without losing them at the end of the year while at the same time helping employers manage the potential liabilities associated with accumulating sick leave. Employers must communicate these caps clearly to their employees to ensure everyone understands how much sick leave they can carry over and the limits on accrual.

Lump Sum (or “Upfront”) Method:

Under the up-front policy for paid sick leave in California, employers are required to provide the full amount of sick leave at the start of each year. This means that employees are granted at least 40 hours or five days of paid sick leave immediately at the beginning of their employment year, calendar year, or designated 12-month period. This policy ensures that employees have immediate access to their full sick leave entitlement without having to accrue it over time.

For new hires, the up-front policy has specific provisions to ensure adequate sick leave is available early in their employment. Employees must have access to at least three days or 24 hours of sick leave by the 120th calendar day of employment and the full five days or 40 hours by the 200th calendar day. This approach provides new employees with necessary sick leave during their initial months of employment while maintaining the overall annual sick leave requirement. The up-front policy simplifies administration for employers and guarantees that employees can utilize their sick leave when needed without delay.

What Defines the 12 Month Accrual Period?

The 12-month accrual period for paid sick leave in California can be defined by the employer based on several acceptable methods. Employers have the flexibility to choose a calendar year (January to December), a fiscal year that may begin and end in any month, or a 12-month period starting from the employee’s anniversary date of hire. Each method is designed to accommodate different organizational needs and operational calendars.

Employers must clearly articulate their chosen accrual period in their policies, employee handbooks, or notices to avoid confusion. If an employer decides to switch from an up-front method to an accrual method, they can prorate the employee’s sick leave based on the calendar term and the number of days due.

What Impact Will This Policy Have on Existing Employer PTO Plans?

The new California paid sick leave policy impacts existing employer Paid Time Off (PTO) plans by requiring them to meet or exceed state-mandated minimums for accrual time and overall calendar year guarantees. Employers with PTO plans that already provide more than five days or 40 hours of leave annually are compliant with the new law. These plans must also allow for the accrual of up to ten days or 80 hours of paid sick leave to meet state requirements. Essentially, as long as the PTO plan offers benefits that align with or surpass these guidelines, no additional leave is required.

For employers with PTO plans historically earmarked for vacation or other purposes, compliance with the new law is still achieved if the plan exceeds the sick leave requirements. This means businesses do not need to provide extra days beyond what is already included in their PTO offerings. Additionally, organizations with unlimited paid sick leave plans automatically comply, as “unlimited” exceeds the 40-hour minimum. These employers need only to indicate the unlimited nature of their PTO on worker pay stubs. Older plans in existence before January 1, 2015, may be “grandfathered in” as long as they meet specific accrual and eligibility criteria. This is designed to ensure minimal disruption to existing policies while maintaining compliance with the new law.

How Can Paid Sick Leave Time Be Used Under New Law?

Employees can use their sick leave for a variety of purposes related to their health and well-being. Permitted uses of paid sick leave include:

- Preventative Care: This includes services such as annual physicals, flu shots, and other seasonal immunizations for the employee or a family member.

- Treatment for Existing Health Conditions: Employees can take time off to receive medical diagnosis, care, or treatment for themselves or their family members.

- Domestic Violence, Sexual Assault, or Stalking: Paid sick leave can be used for services associated with these issues like counseling, legal services, or relocation.

- Care for Family Members: This includes caring for a parent, child, spouse, registered domestic partner, grandparent, grandchild, sibling, or a designated person who needs medical attention.

The law is designed to provide employees with the flexibility to determine how much paid sick leave they need, whether it’s a full day or just a few hours. Employers can require a minimum usage of two hours at a time, but the decision on the exact amount of leave taken is up to the employee. This ensures that workers can adequately address their health needs or those of their loved ones without unnecessary constraints.

How Do I Know How Much Paid Sick Time I Have Off?

Employers are required to display the number of accrued paid sick leave available to each employee on their pay stub or on a document issued the same day as their paycheck. If the employer offers unlimited paid sick leave or unlimited paid time off, they can simply indicate “unlimited” on the pay stub or accompanying document. Additionally, employers must maintain records of the paid sick days earned and used by each employee for at least three years. These records should be accessible to employees, either electronically or in paper form so that workers can easily track their available paid sick leave at any time.

How are Sick Leave Hours Tracked and Paid?

Sick leave hours in California are meticulously tracked and transparently reported to ensure compliance and clarity for both employers and employees. Employers are required to itemize sick leave hours on pay stubs or provide this information through another accessible method, such as a web portal or software system. This transparency helps workers keep track of their available paid sick leave and ensures that there is minimal confusion about their benefits.

Payment for sick leave varies based on the employee’s designation. For non-exempt employees, sick leave must be paid at their regular, non-overtime hourly rate and should be reflected on their pay stubs within the same pay period the leave was taken, or no later than the next regular payroll period. Employers can calculate this pay by either using the employee’s regular rate for the workweek in which the sick leave was used or by averaging the employee’s total compensation over the previous 90 days, excluding overtime. Exempt employees are paid for sick leave at the same rate used for other forms of paid leave, such as vacation or PTO. This ensures consistency in how paid leave is compensated and helps maintain fairness across different types of employees.

Can I Get an Advance on Paid Sick Leave?

An employer may choose to advance paid sick leave to employees before it is accrued, but this is not a requirement under California law. This means that while some employers might offer the flexibility of granting sick leave in advance as a benefit, they are not legally obligated to do so. Employees should check with their employer to understand the specific policies and provisions regarding the advancement of paid sick leave in their workplace.

Can I Cash Out Sick Days Like Other Earned Benefits?

You cannot cash out unused sick days like other earned benefits unless your employer’s policy specifically provides for such a payout. Under California law, paid sick leave is intended to be used for health-related absences and is not typically paid out upon termination of employment. However, if you leave your job and are rehired by the same employer within 12 months, you are entitled to reclaim any accrued paid sick leave as long as it was not cashed out under a paid time off policy at the time of termination. This ensures that employees retain their earned sick leave benefits if they return to the same employer within a year.

Can An Employer Deny Sick Time in California?

In California, an employer generally cannot deny an employee’s request for paid sick leave if they have accrued the necessary time. Employees are entitled to use their paid sick leave upon making an oral or written request and employers cannot deny this leave based solely on the lack of medical certification. However, if the employee has exhausted their accrued sick leave or the request is for a non-protected reason, the employer may deny the request.

How to Deal with an Employer Who Denies Sick Days or Fails to Pay Sick Leave?

If an employer does not provide their employees with paid sick leave, tries to deny sick leave, does not pay for utilized sick time, or commits other violations of sick leave laws, then the employees has a wage claim that is grounds for suing your employer.

How Should Employees Notify Their Employers of Taking Sick Time?

Employees should notify their employers of their intention to use sick time as soon as is practical. For planned sick leave like a scheduled doctor’s visit or surgery, employees are expected to provide as much advance notice as possible. In cases of unforeseen illnesses or emergencies, employees should inform their employer as soon as they are able. This ensures that employers are aware of the absence and can make necessary adjustments while respecting the employee’s need to take time off for health-related reasons.

Are Employees Required to Take a Full Day of Paid Sick Leave Off?

Employees are not required to take a full day of paid sick leave for shorter absences like a three-hour dental appointment. Employees have the right to decide how much paid sick leave they need to use. Employers can set a minimum increment for paid sick leave that cannot exceed two hours per instance. This flexibility allows employees to use their sick leave more efficiently for partial-day absences without needing to take an entire day off.

Can Employees in California Still Take Unpaid Time Off if They Are Out of Sick Leave?

Employees in California can take unpaid time off if they are out of sick leave, but it depends on the employer’s policies and the nature of the leave. Under the California Family Rights Act (CFRA) and the federal Family and Medical Leave Act (FMLA), eligible employees can take unpaid leave for certain family and medical reasons. However, outside of these protected leave provisions, taking unpaid time off is subject to the employer’s discretion and policies.

If your employment rights have been violated, call us today at (866) 936 7349 to schedule a free consultation

What Protections are Californians Provided When Using Paid Sick Leave?

California law provides several important protections for employees using paid sick leave. Employers are generally prohibited from requiring proof of a medical visit, illness, or treatment as a condition for taking sick leave. Employees can use their sick leave simply by making an oral or written request. However, employers may ask for documentation if there is reasonable information suggesting that the leave is not being used for a valid purpose. This helps ensure that sick leave is used appropriately while safeguarding employees’ privacy and rights.

Additionally, employees are protected against retaliation for using their accrued sick leave. Employers cannot discharge, threaten to discharge, demote, suspend, or discriminate against an employee for using their sick leave or attempting to exercise their rights under the law. These protections extend to employees who file complaints or participate in investigations related to sick leave violations. However, the law does not protect unexcused absences or sick days taken without any accrued leave. In such cases, employers may discipline employees according to their attendance policies.

Contact Mesriani Law Group if Your Rights to Paid Sick Leave Have Been Violated

If you believe your rights to paid sick leave have been violated, it’s crucial to seek professional legal advice to protect your interests. Mesriani Law Group specializes in employment law and is dedicated to helping workers navigate the complexities of California’s paid sick leave regulations. Our experienced attorneys can provide the guidance and representation you need to ensure your rights are upheld. Don’t hesitate to contact Mesriani Law Group for a consultation and take the first step towards securing the justice and compensation you deserve.

Paid Sick Leave FAQs

What is the new sick time law in California in 2024?

The new sick time law in California, effective January 1, 2024, requires employers to provide at least 40 hours or five days of paid sick leave annually to their employees. This law increases the previous minimum and ensures broader access to paid sick leave for workers across the state.

What are the new labor laws for 2024 in California?

The new labor laws in California for 2024 include an updated paid sick leave requirement, mandating employers to provide at least 40 hours or five days of paid sick leave annually. Additionally, these laws enhance protections for employees using sick leave, ensuring no retaliation for exercising their rights, and require employers to clearly communicate and track sick leave availability.

Is paid sick leave mandatory in California?

Yes, paid sick leave is mandatory in California. As of January 1, 2024, employers are required to provide at least 40 hours or five days of paid sick leave annually to their employees, ensuring all workers have access to necessary time off for health-related issues.

How many days can you call in sick without a doctor's note in California?

In California, employees can call in sick without a doctor's note for the full amount of their accrued paid sick leave. Employers generally cannot require medical certification for employees to use their paid sick leave, allowing them to take up to 40 hours or five days off annually without needing to provide a doctor's note.

Can an employer deny sick pay?

In California, an employer cannot deny sick pay to an employee who has accrued paid sick leave and requests to use it for a valid reason covered by the law. Employees are entitled to use their paid sick leave without needing to provide medical certification, and employers must honor these requests as long as the employee has available sick leave hours.